Recently, my mum saw her Chinese friend using the Touch ‘n Go e-wallet to make payment at a retail pharmacy outlet. As my mum has yet to experience what’s it like to use an e-wallet, she was impressed by how the system/technology worked. By the time my mum related to me about this, it was too late for me to ask the China national about it, as she was preparing to leave Malaysia (after having worked and studied in the country for a number of years). Personally I’ve come across a number of outlets that have e-wallets as one of their methods of payment, though I’m still waiting for the day that I’ll be confident enough to use it. So I decided to hunt for at least one person who has been using the payment system.

*WSY, in her early 30s, initially had her concerns about using an e-wallet. However, all that changed when a friend influenced her. Since early-2019, WSY has been a user of Touch ‘n Go e-wallet, GrabPay and Samsung Pay. Many of WSY’s friends are also using e-wallets, including the ones she is currently using because they are widely accepted in a variety of outlets. She also shared that her younger sister is a Platinum user of GrabPay. “The e-wallets available in the market are being regulated by Bank Negara Malaysia (BNM)”, WSY stated.

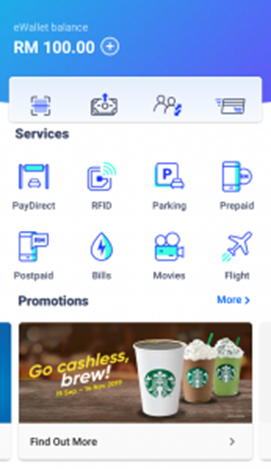

“I use Touch ‘n Go e-wallet as it is accepted at Starbucks, which is my favourite outlet for coffee, hahaha ???? As for Grab Pay, I recently got a 20% discount on my total bill, as part of a promotion held by a certain restaurant. On Samsung Pay, she highlighted, “Samsung Pay is the only one which does not require any Internet connection in order for payment to take place, because it works as long as the terminal accepts contactless payment, what you would have known as PayWave.” It is also advisable to check whether the device you’re using is supported because Samsung Pay only works on certain phones that are of a higher end. I also found out that a user of Samsung Pay is allowed a maximum of ten transactions without an Internet connection.

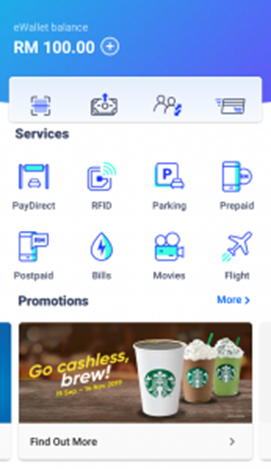

Touch ‘n Go e-wallet app main screen

A promotion by Touch ‘n Go e-wallet

“You’ll need your IC number and your mobile number for registration purposes [once you’ve gotten the corresponding e-wallet app installed into your phone]. For security purposes, it’s better to have a PIN, so that unauthorised access or any suspicious activity will be detected and blocked, as much as possible.”

On whether she has transferred money before, “I have not used that function so far because you need to take a one-time selfie for identification purposes [before any amount can be transferred].”

For payment to be made, the user is required to scan the quick response (QR) code using his/her smartphone. Then, the user would usually enter the payment amount. However, in certain cases like when using the Touch ‘n Go e-wallet, the merchant has to scan a QR code on your phone screen, before you are required to enter your six-digit PIN, and then confirm payment.

Besides getting to reduce the amount of physical cash in your existing physical wallet, you can also earn rewards when using e-wallet as the method of payment. WSY, who is working at a subsidiary of a banking group, said that she personally prefers to reload her (e-wallet) credits through the e-wallet app using her credit card. This allows her to also enjoy credit card rewards. The acceptable ways to reload one’s e-wallet credits are via online banking, debit card, and credit card.

On whether her parents know how to use it, “Even though they have their own smartphones, they still do not know how to use e-wallets.”

On the downsides, WSY said, “As most e-wallets require an Internet connection, e-wallets can become useless if you’re not within the area of coverage.” Your phone’s battery life is also something to consider as you should “never take your phone’s battery life for granted.”

I’ll be right back. My cousin has been pestering me to use her Touch ‘n Go e-wallet referral code ????

Notes: The participant has agreed to be identified as such.

Touch ‘n Go initially started as a smart card for toll payments, as the only electronic payment system, meant for use at many expressways and highways in Malaysia. The smart card can be used to pay for some other retail items.

Grab started out as a ride-sharing platform, before eventually branching out into food delivery with a separate GrabFood mobile app, and of course, much later, it now has its own GrabPay. All of Grab’s services are now parked under one single Grab mobile app.

Samsung Pay is the mobile payment system initiated by the electronics giant, Samsung.

Showing 0 comments